Planning for 2023 Tax Efficiency Today

Many business owners use this time of year to put taxes out of mind and just “get through the balance of the year with decent recordkeeping.”

It can be easy to count on the promise of a new year push to finally sort everything else out when it comes to your business finances. This strategy is a bad idea on two fronts, though. Rushing through filings and bookkeeping to meet looming deadlines can distract you from focusing on actually running your business. And even worse, putting off planning for the future means you can lose out on critical opportunities to make changes and decisions that could put you in a better spot come tax filing time.

Let’s review some items you should be thinking about now as a business owner as you look ahead to 2023 and beyond. Don’t let the autumn doldrums keep you from making tax-efficient choices now that can positively impact your business in the months and years ahead.

#1: Are You Outgrowing Your Business Structure?

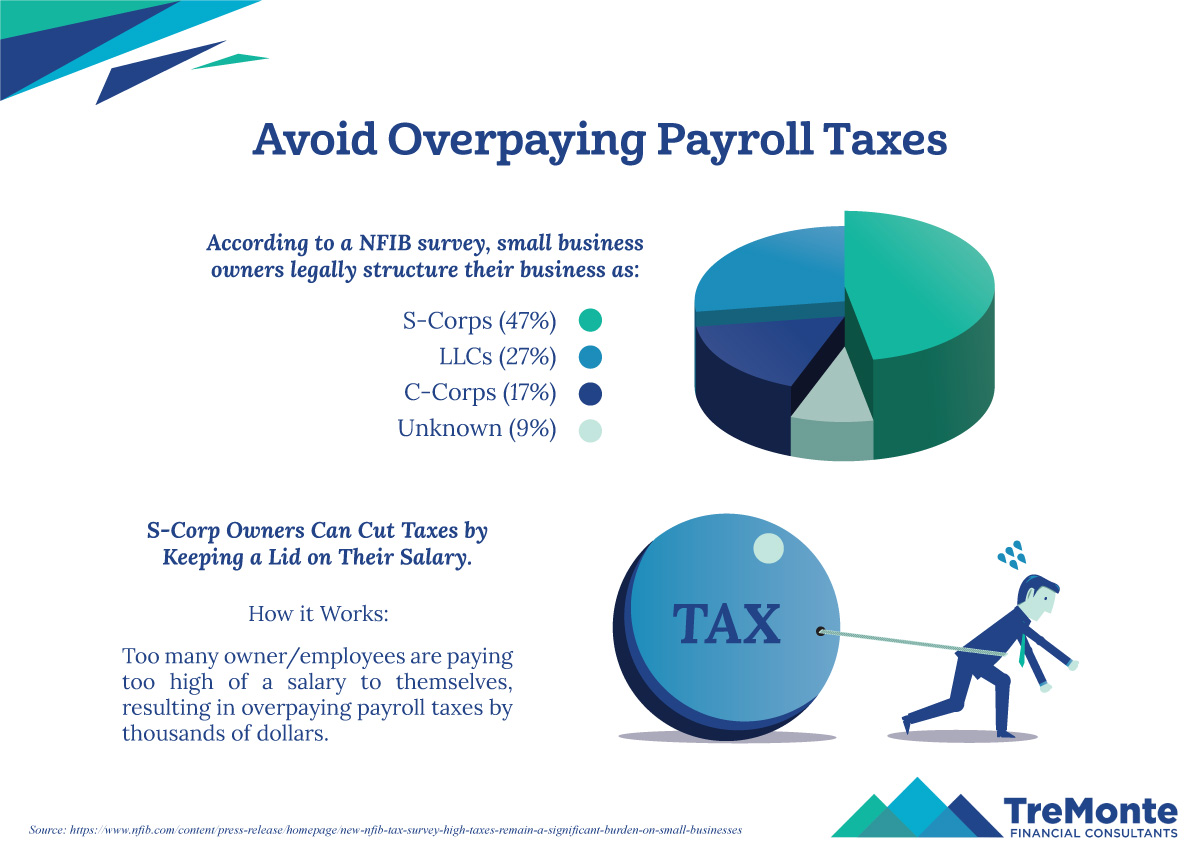

Most businesses start out as sole proprietors, because it’s an easy and cost-effective way to hit the ground running. But the cost-benefit analysis of running your business as a sole proprietorship can change quickly once you approach $40,000-$50,000 or more in business net income.

There can be some upfront costs with making an entity change from, say, a sole prop to an S-corp. There are also higher annual expenses with running as an S-corp that may amount to a couple thousand dollars per year. But as a sole proprietorship, you can be taxed at up to three different levels—federal income tax, state income tax, plus the oft-dreaded federal self-employment tax.

Converting to an S-Corporation can save on those self-employment taxes, since you’ll only be taxed on the portion of net income you pay yourself as salary. As long as the ratio of salary to distributions is within reason, you can pay yourself the remainder of your net business income as a distribution that is free from payroll taxes.

Don’t make an entity change mid-year, though. The window of time between January 1st to March 15th of a new calendar year is typically the best time to make a shift in corporate structuring. You should already have enough of this year’s financial outcome in the books to make some reasonable assumptions about what your top and bottom line will look like, though. Use that information and modeling to start a discussion with your tax advisor about the best option for your business’ structure going forward.

#2: Conduct a QBI Checkup

The Qualified Business Income (QBI) tax credit was a key feature of the 2017 Tax Cuts and Jobs Act, allowing for a 20% deduction of qualified self-employed and small business income through 2025. As you may already know, the QBI comes with lots of asterisks; after all, it’s written by the government. These restrictions include what type of businesses can claim it, when it phases out based on income, and what actually qualifies as business income.

“Qualified business income is defined as “the net amount of qualified items of income, gain, deduction and loss with respect to any trade or business.” Broadly speaking, that means your business’s net profit.

But it also means that not all business income qualifies. QBI excludes:

- Capital gains or losses.

- Interest income.

- Income earned outside the U.S.

- Certain wage and guaranteed payments made to partners and shareholders.”[1]

For tax year 2022, the QBI begins to phase out at $170,050 for single-filers, and $340,100 for married, joint filers. Above these levels, the IRS has a complicated set of rules to determine whether your business income qualifies for a full or partial deduction.

There are many steps you might be able to take to get your taxable income below this threshold, but there are even more rules defining who can put these tax advantages to work. For example, many service-related businesses that rely on the knowledge and skill of one or more people are excluded from being able to claim the QBI.

Chances are you already know your eligibility as a business, but checking with your tax advisor to discuss the eligibility potential, especially if your net income is forecasting to be within range of the phaseout limits for 2022, can be a great way to potentially leverage some tax savings.

Your advisor can also talk through retirement accounts, health savings accounts (HSAs), Roth IRA conversions, and front-loaded business growth expenses that might make you eligible for the QBI deduction this year (or next year) with the right strategy moves today.

#3: Can You Put the Kid(s) to Work?

Resourceful small business owners often put their children to work helping out the business, especially during the summer months when school is out. With some straightforward planning and paperwork, this can be a financial win-win for both the child and the parent business owner. We can’t speak to the win (or loss) for your sanity.

If you employed your child(ren) this year or are considering it, make sure you have kept key records about what they have done for your business and what you paid them to ensure you can claim up to the full standard deduction of $12,950 for 2022. Any wages paid below that level will not only be tax-free to the child, but fully deductible for your business. You can use this time of year to make sure they have proper bank accounts set up and paperwork filled out, and that you recorded all their hours along with task(s) completed in a diligent manner. Make sure whatever you’ve paid them to do is reasonable (i.e. no accounting, you can leave that to Tremonte).

#4: Conduct a Retirement Plan Checkup

Owning a small business puts the onus on you to set up your own retirement plan—there isn’t anyone else who’s going to do it for you! The same goes for your employees, if you have them.

Assuming you have some combination of a SEP IRA, Individual IRA, or a qualified plan, reacquaint yourself with the contribution maximums for 2022 and see if you’re on pace to max out what you can, where you can. If you’re a sole proprietor, a SEP IRA can be one of your best friends, with contribution limits up to $61,000 (or up to 25% of your compensation) in 2022—about ten times what you can stick away in a traditional or Roth IRA. And all SEP IRA contributions are fully tax-deductible, while traditional IRAs have income ceilings on deductibility.

If you have employees who have worked three years or more for you and received at least $600 in wages, you may want to consider transitioning toward a more standard qualified 401(k) plan or a SIMPLE plan, as you’ll soon need to offer retirement benefits to your employees and match their contributions in future tax years. Setting up a qualified plan (with tax deductibility) during this calendar year will allow your 2022 contributions to be eligible for tax deductions on your 2023 filings.

Small businesses that start up a new qualified plan can also claim a credit of up to 50% of plan setup and onboarding costs for the first three years of the new plan (up to a cap of $5,000, based on number of employees who participate).

#5: Review the Run-Rate of Your Financials

The COVID pandemic has so drastically impacted businesses over the past few years that finding an accurate “baseline” of your finances can be tremendously challenging. It’s still important to try to project what your revenue and net income will look like this year and beyond, though. Knowing these key factors can be a powerful driver of tax and corporate structure strategy and planning.

Do you anticipate being in a lower tax bracket in 2023? If so, you may want to consider decelerating invoicing and other receivables where you can to defer more revenue into 2023. Conversely, if you think there’s a good chance you’ll be in a higher tax bracket next year, consider pulling forward any receivables you can into this calendar year.

Now is also the perfect time to review your multi-year strategy and growth goals. Are there areas of your business like staffing, outsourcing, or equipment that need some capital infusion? Given that individual and corporate tax rates could climb in the years ahead, this could be a good year to spend some money, reduce profits, and even carry forward some net losses as a strategic choice.

Consider making a list today of all the expenses you might want to take on before calendar year-end and budget accordingly. Spending on growth is generally a good thing at any time, but planning key purchases around your tax liability profile can be a way to turn a good thing into a great one for your bottom line.

If you have a segment of your business that you’ve been thinking of winding down or selling, it may be more beneficial to make tax planning choices that favor your financials instead. Putting a solid profit into the books for 2022 may mean paying a little more in taxes now so you can maximize a third-party valuation of your business in the future.

#6 – Schmooze It Up in 2022

Remember that 100% tax deductibility of business-related meals (and related entertainment expenses) lasts through the rest of 2022. So get all those business meetings on your calendar soon before the deductibility falls back to 50% in 2023.

Here at TreMonte, we can help you determine the right “micro” strategies for minimizing taxes in any corporate structure, while providing key insights on when to consider bigger shifts to corporate structure, retirement plans, and health plans. Banish tax planning from the depths of frustration and distraction by reaching out to a member of our team today for an initial consultation.

[1] https://www.nerdwallet.com/article/taxes/qualified-business-income-deduction