Are you curious about conservation easements? Some of our clients are, so we thought we would put out a PSA (or maybe more of a “buyer beware”) article on this interesting strategy that can potentially allow a path to significant tax savings — with plenty of fine print and IRS scrutiny thrown in for good measure.

Before we jump into the nuts and bolts of the conservation easement strategy, let’s take a side step for a moment and talk about the history of this tax deduction. In general, most people would agree that stretches of undeveloped land can do a lot of good for a community. Congress recognizes that benefit and allows an income tax deduction for property owners who give up certain rights of ownership to preserve their land (or buildings) for future generations.

And when we are talking income tax deduction, it could potentially be big enough to eliminate all taxable income in a given year.

As you might imagine, this got a lot of people excited.

Predictably, it has also led to some taxpayers getting a bit too creative, stretching the intent of the law, or straight-up cheating.

The IRS saw some individuals take inappropriately large deductions for easements that were not backed by any substantive valuation or evidence. Some have attempted to claim deductions that they were not legally entitled to, ignoring the fact that you cannot give up a right that you don’t legally have. A few would claim an easement which is meant to be permanent, get a deduction, and then proceed to develop the property in a way that went against the easement’s restrictions. And let’s not forget those who would buy into a syndicated conservation easement (think a tax shelter, similar to buying tax credits that have no economic substance behind them).

In other words, a few people tried to cheat (or were misled by bad advice) — and now the IRS looks at conservation easements with a lot of scrutiny. Nobody can guarantee that using a certain deduction is a 100% path to an audit…and yet, this is definitely one of those red flags.

Having said all that, when used appropriately and in the right circumstances, a conservation easement is a powerful strategy that can potentially eliminate all taxable income in a given year.

Tax Strategy: Conservation Easements

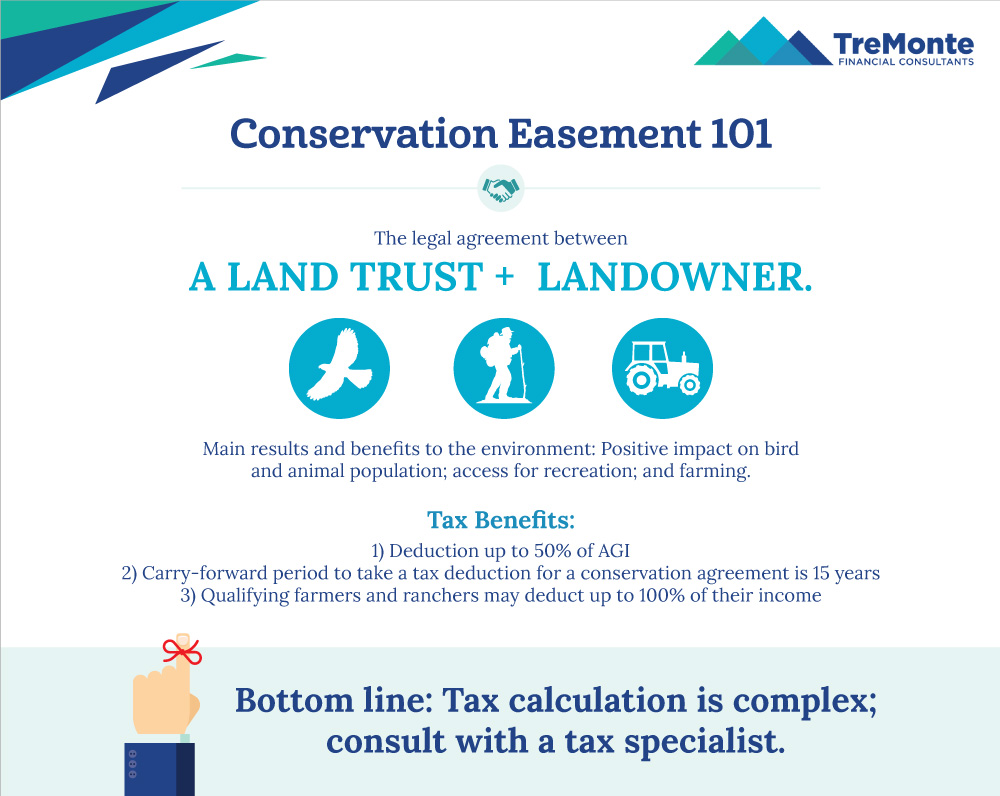

A conservation easement is an investment in a qualified private land conservation organization or government. The idea is to give up some of the legal ownership rights in order to achieve certain conservation purposes, like preservation of land areas for outdoor recreation, protection of habitat, preservation of open space, or preservation of historically important land, area, or buildings.

Advantages:

- The deduction is available to individuals and to businesses (whoever is the legal owner of the property being considered for a conservation easement).

- There is an option for carrying the “leftover” deduction over for up to 15 years.

Caution:

- You must sign a legal agreement, called a Deed of Easement, with legally binding restrictions on the development and/or use of the property.

- You need documentation that gives you an iron-clad explanation to justify the size of the deduction.

- Perpetuity is a fundamental requirement. That means no claiming a deduction and then “accidentally” developing the property a few years down the line.

- You will need to pull together a pile of paperwork, including a Deed of Easement, a Contemporaneous Written Acknowledgment (CWA), an appraisal, and a Baseline Documentation Report to establish the condition of the property at the time the easement is transferred.

Savings Range:

- 90-120% of current tax rate

Good Business: A Tax Guide to Conservation Easements

Did we discourage you from a conservation easement? It is definitely not for everyone, although in the right hands, and for the right circumstances, it can do a lot of good (and save a lot of money in taxes). If you are considering a conservation easement, we recommend speaking with a tax planner first.

Here at TreMonte, we can help you figure out if your situation would benefit from incorporating conservation easement strategy into your tax plan. Reach out to a member of our team today!

Also, if you enjoy the kinds of topics we tackle on this blog, you will probably love our new podcast. Find your way to listen HERE— and join me for more fun and wisdom from Traverse City entrepreneurs and business owners like yourself. Enjoy!